A personal investment strategy, based on your specific goals, is the main vehicle we use to help you live abundantly and generously.

Through our internal investment review process, our team is able to advise and personally manage your investment portfolio. We maintain a direct connection with your investments and an active review which helps us keep you on track.

Our asset management capabilities include both a dividend stock strategy as well as a manager-driven, all-weather strategy. The way in which we employ and combine these strategies depends on your individual needs and objectives.

The focus of our primary investment philosophy is to identify high-quality companies that pay and grow dividends.

Dividends represent cash payments to shareholders, which creates the opportunity to design a diversified, predictable, and growing income stream that aligns with your long-term financial plan.

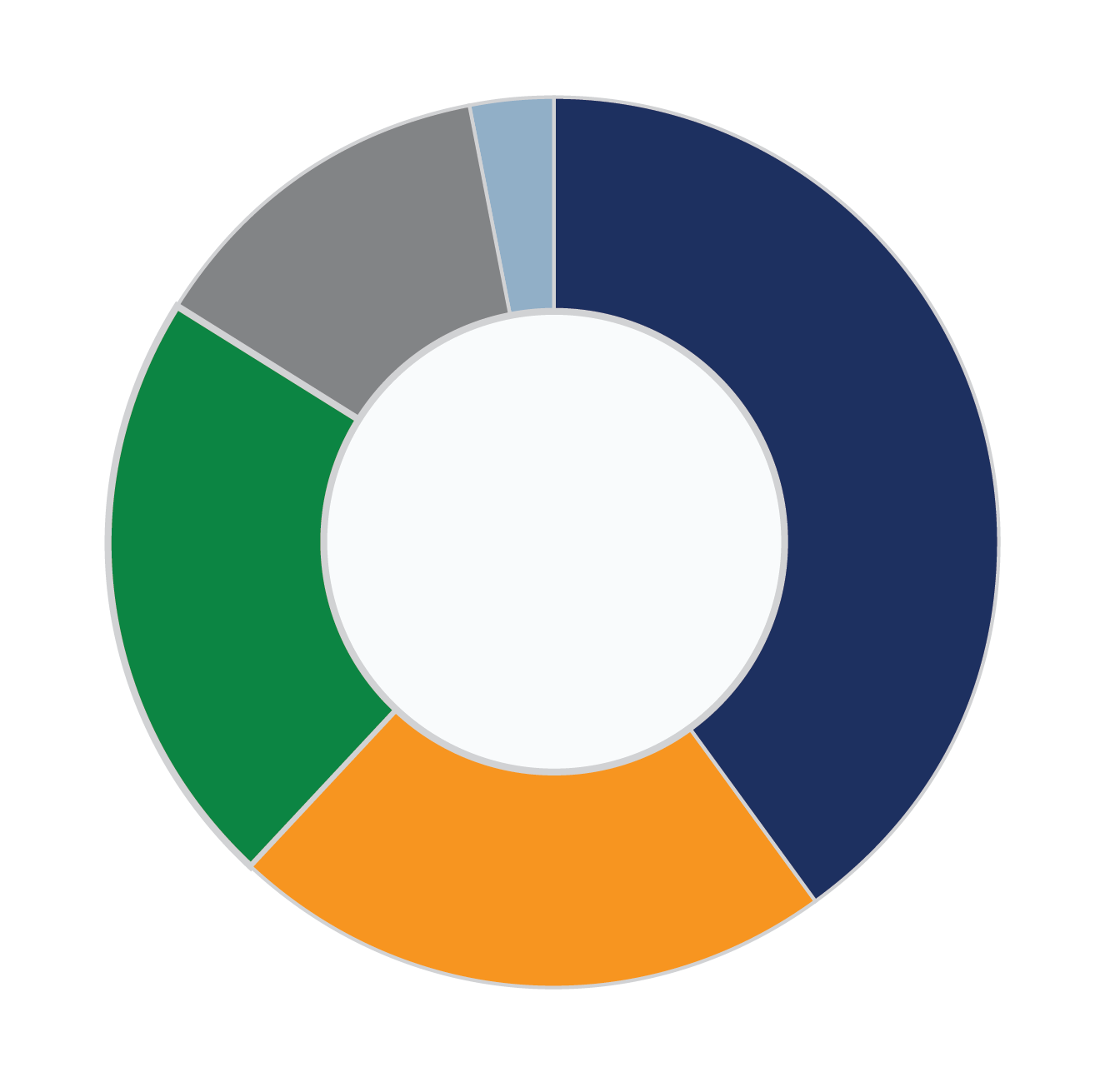

Our Growing Dividend Stock Strategy consists mainly of large, industry-leading companies. We seek out those with a long track record of paying and growing dividends.

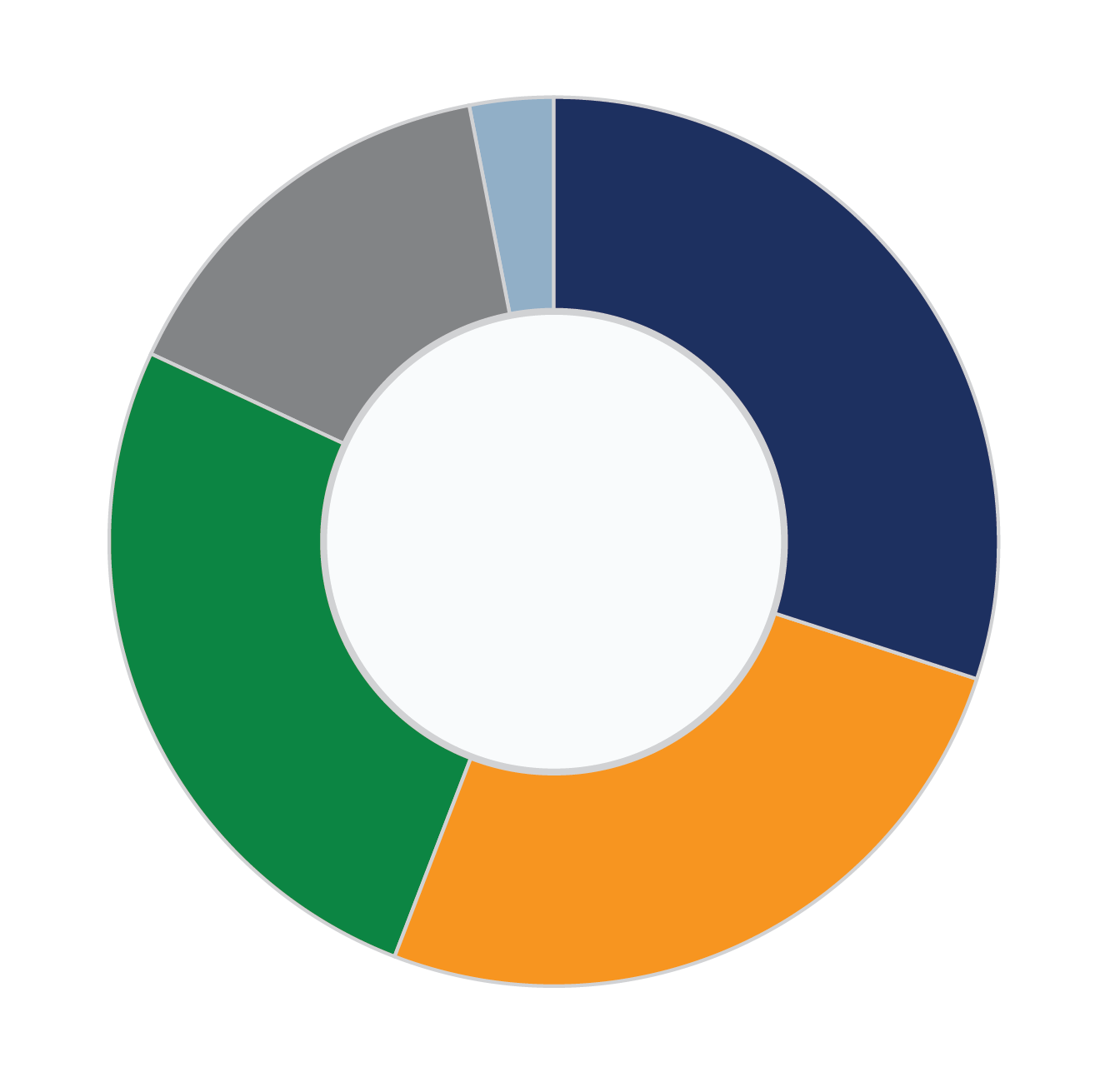

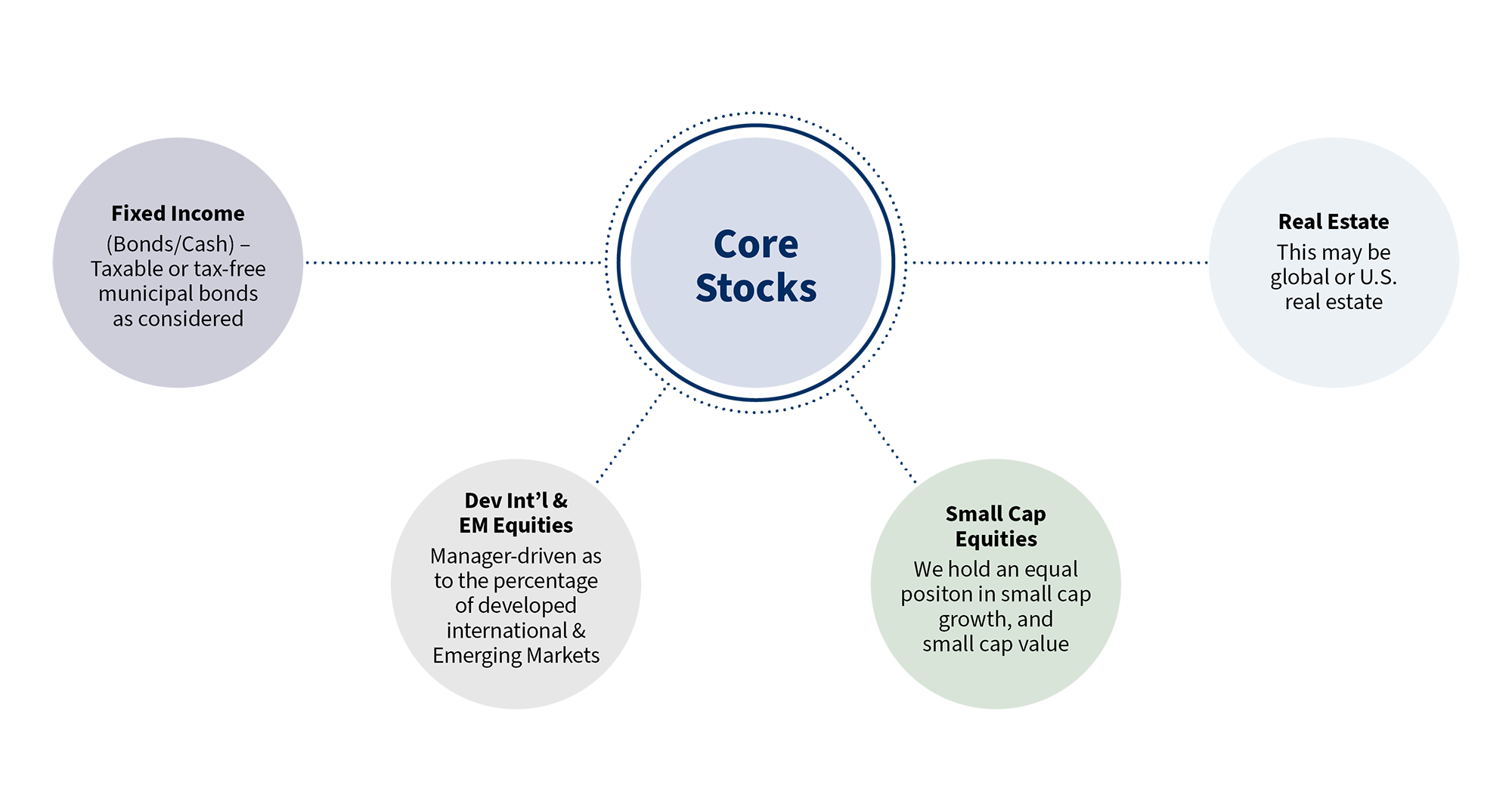

Our manager-driven strategies are designed to help you weather all markets, by incorporating high-quality investments within stated style boxes.

This generally results in equal weightings in large and small companies, value and growth stocks, and international and emerging markets. We often incorporate what we consider to be alternative markets as a small, tactical component of the strategy. Ultimately, we created the All-Weather Strategy to help our clients reach their desired financial goals.

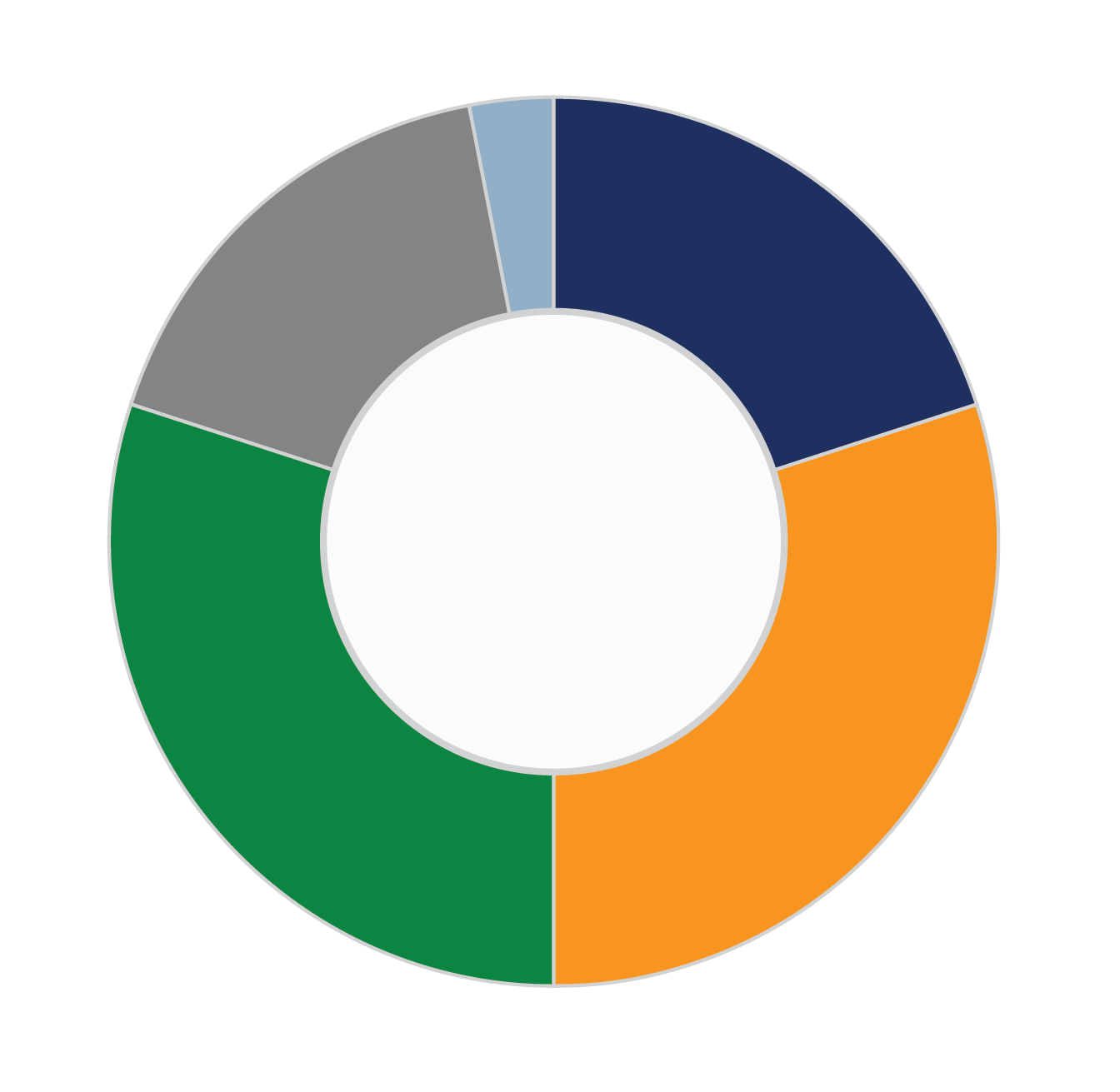

In designing investment strategies for our clients, we may combine our above two solutions into a customized strategy based on your needs.

We often encircle our core strategy with smaller percentages in small-cap equities, international and emerging market equities, real estate, and fixed income.

While our investment philosophy is consistent across all client strategies, no two portfolios are the same.

That’s because portfolio design always comes after careful consideration of the goals, needs, and circumstances that we uncover through our custom discovery process.

For example, if our four key life questions uncover a family priority that requires changes in cash flow, we can customize your investment portfolio to reflect that goal. We can specifically select dividend-paying equities or adjust your mix of investments to account for a wide variety of needs, including current income requirements or tax considerations. If you simply have a particular investment position you wish to retain, we can often accommodate such preferences.

205 N. Lakeshore Blvd, Suite B

Marquette, Michigan 49855 USA

Tel. 906-226-0880

Fax. 906-226-1767

*The 2023 Forbes ranking of America’s Top Wealth Management Teams Best-In-State, developed by SHOOK Research, is based on an algorithm of qualitative criteria, mostly gained through telephone and in-person due diligence interviews, and quantitative data. This ranking is based upon the period from 4/1/2021 to 3/31/2022 and was released on 01/12/2023. Advisor teams that are considered must have one advisor with a minimum of seven years of experience, have been in existence as a team for at least one year, have at least 5 team members, and have been nominated by their firm. The algorithm weights factors like revenue trends, assets under management, compliance records, industry experience and those that encompass best practices in their practices and approach to working with clients. Portfolio performance is not a criteria due to varying client objectives and lack of audited data. Out of approximately 8,000 team nominations, 2,860 advisor teams received the award based on thresholds. This ranking is not indicative of an advisor’s future performance, is not an endorsement, and may not be representative of individual clients’ experience. Neither Raymond James nor any of its Financial Advisors or RIA firms pay a fee in exchange for this award/rating. Raymond James is not affiliated with Forbes or Shook Research, LLC. Please see https://www.forbes.com/lists/list-directory/#470ac626b274 for more info.

Securities offered through Raymond James Financial Services, Inc., Member FINRA/SIPC.

Raymond James financial advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Therefore, a response to a request for information may be delayed. Please note that not all of the investments and services mentioned are available in every state. Investors outside of the United States are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this site. Contact your local Raymond James office for information and availability. Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members.

Mark Aho Financial Group is not a registered broker/dealer, and is independent of Raymond James Financial Services. Investment Advisory Services are offered through Raymond James Financial Services Advisors, Inc.

Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.

Check the background of this firm on FINRA’s BrokerCheck